The Upland Advantage

Upland Real Estate Group, Inc., which was founded in 1995, is a Minneapolis based commercial real estate investment sales and brokerage company, focusing on passive real investments, 1031 solutions, real estate portfolio diversification, and wealth preservation.

Our ability to swiftly match buyers with sellers, along with our proven, systematic sales process, the Net Lease Investor Maximizer has made Upland Real Estate Group one of the nation’s primary resources for the purchase and sale of net lease, credit investment properties.

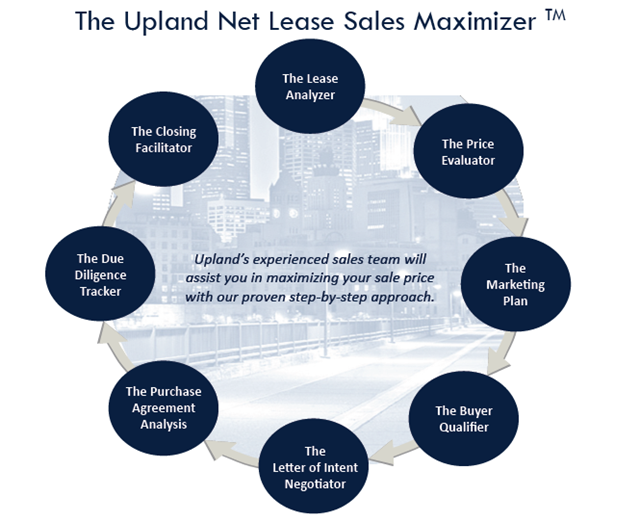

Net Lease Sales Maximizer

- Lease Analyzer: Review clauses & tenant strength

- Price Evaluator: Provide comps & determine value

- Guerilla Marketing Plan: Multi-stage marketing

- Buyer Qualifier: Questionnaire for investors

- Letter of Intent Navigator: Provide LOI form & negotiate

- Purchase Agreement Analysis: Ensure PA consistency

- Due Diligence Tracker: Checklist for all DD items

- Closing Facilitator: Track critical dates to ensure closing

Benefits of Working with Upland

- Access to 1031 Buyers, Family Trusts, REITs

- Receive Quarterly Net Lease Cheat Sheet

- Provide For Sale and Sold Comps

- Over 50 Years of Net Lease Sales Experience

- Nationally recognized CCIM accredited Sales Team

- Excellent Reputation and Credibility

- Prompt Follow-up and Attention to Detail

The Upland Net Lease Sales Maximizer

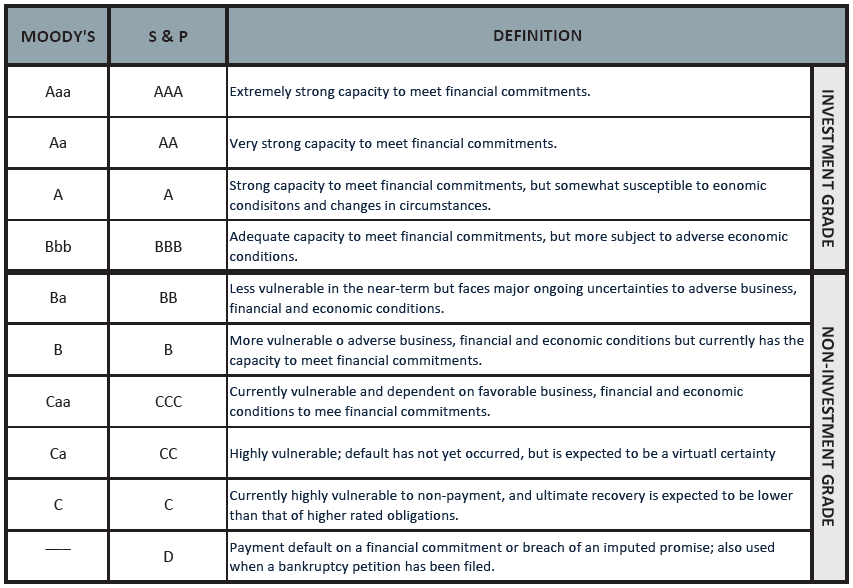

Moody's S&P Rating Scale

Bond investors share a common concern, uncertainty as to whether they will get their money back, with interest. That’s where independent credit-rating services come in. These companies evaluate the financial strength of bond issuers and summarize their findings in a simple grade. Thus, investors can easily identify bonds that might have trouble paying off. The following is a description of the rating system utilized by the two largest rating agencies, Standard & Poor’s Corp. (S&P) and Moody’s Investor Service.

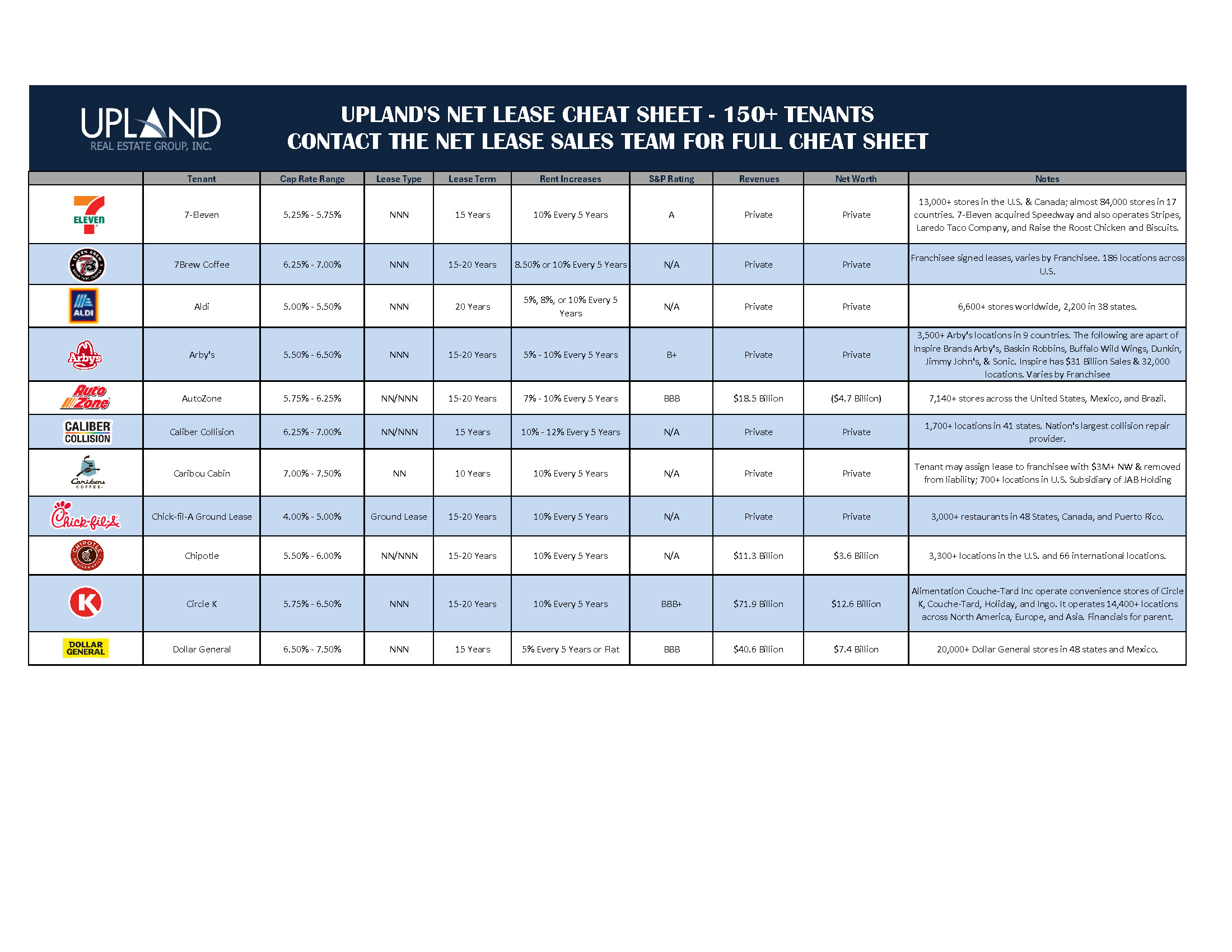

Contact Our Team For Full Net Lease Cheat Sheet

For more precise evaluations, S&P someimtes adds “A+” or “A-” to a letter grade, while Moody’s might add a 1. For example, a bond rated A+ or A1 would outrank an A.

Net Lease Matrix

Contact Our Team For Full Net Lease Cheat Sheet

Contact Our Team For Full Net Lease Cheat Sheet